Debtholders

Getlink SE Green Bonds

Green Bonds – March 2025

- Getlink SE : Green notes issue launch

- Getlink SE’s credit rating upgraded by S&P Global Ratings and Fitch Ratings

- Getlink SE successful pricing green notes

Green Bonds – October 2020

- Green Bond Proceeds Allocation Report Getlink SE – December 2023

- Green Bond Proceeds Allocation Report Channel Link Enterprises Finance LTD /Eurotunnel – December 2023

- Green Bond Proceeds Allocation Report Getlink SE – December 2022

- Green Bond Proceeds Allocation Report Channel Link Enterprises Finance LTD /Eurotunnel – December 2022

- Getlink Green Finance Framework – April 2022

- DNV GL Eligibility Assessment – Second Party Opinion – April 2022

- Green Bond Proceeds Allocation Report – April 2022

- Green Bond Proceeds Allocation Report – December 2021

- External Auditors’ Report on Green Bond Proceeds Allocation Report (french version) – December 2021

- GETLINK SE: Pricing of additional senior secured “green” notes due 2025 – Press release published on 26 October 2021 at 4:30 p.m.

- GETLINK SE: Issue of additional senior secured “green” notes due 2025 (Inside information) – Press release published on 25 October 2021 at 7:15 a.m.

- Getlink Green Finance Framework – October 2021

- Green Bond Proceeds Allocation Report – October 2021

- Getlink: Success of the Group’s Green Bonds refinancing (inside information) – Press release published on 22 October 2020 at 02:30 p.m.

- GETLINK SE: Issue of senior secured “green” notes – Refinancing of the senior secured “green” notes due 2023 – Press release published on 20 October 2020 at 07:15 a.m.

- Getlink Green Finance Framework

- DNV GL Eligibility Assessment – Second Party Opinion

Green Bonds – September 2018

- Green Bond Proceeds Allocation Report – March 2020

- Getlink successfully prices its first issue of Green Bonds – Press release published on 26 September 2018 at 5:30 p.m.

- Getlink’s first issue of Green Bonds – Press release published on 24 September 2018 at 07:00 a.m.

- Green Bond Framework

- DNV GL Eligibility assessment

Eurotunnel debt

Description – Eurotunnel Term Loan

In April 2018, the corporate reorganisation of the Group lead to the creation of a separate “Eurotunnel” sub-group for the operation of the Fixed Link distinct from the Group’s other business sectors. This involved the transfer of the two Concessionaires companies (FM SA and CTG Ltd) to Eurotunnel Holding SAS, which became the new holding company for the sub-group and replaced Getlink SE as guarantor in respect of the Term Loan.

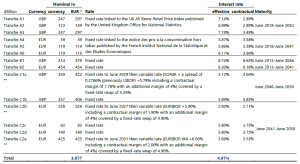

The Term Loan put in place on 28 June 2007, as modified on 24 December 2015, 6 June 2017, 13 April 2018, 12 May 2022 and 6 December 2022, comprises the following elements at 31 December 2024:

* Nominal amount excluding impact of effective interest rate and inflation indexation and at the exchange rate at 31 December 2024 (£1=€1.206).

** The contractual interest rates for C1a, C2e and C2b are respectively SONIA + a spread of 0.2766 (previously LIBOR) +5.78% from June 2029, EURIBOR +6.00% from June 2031 and EURIBOR +5.90% from June 2027. From these dates, the effective interest rates for C1a, C2e and C2b with hedging are respectively 8.22%, 7.46% and 8.96%.

For more information, see note G in section 1.2 of the 2024 Universal Registration Document.

Lender: Channel Link Enterprises Finance Plc (CLEF), a debt securitisation vehicle created by the original lenders in August 2007